Our Mission

Insurance advisory intelligent, trustworthy, and truly need-based.

At Argus Fintech, we’re on a mission to make insurance advisory intelligent, trustworthy, and truly need-based. We believe insurance should be recommended with clarity — backed by data and aligned with real financial goals.

Why We Exist?

Clarity In Every Clause.Confidence In Every Call

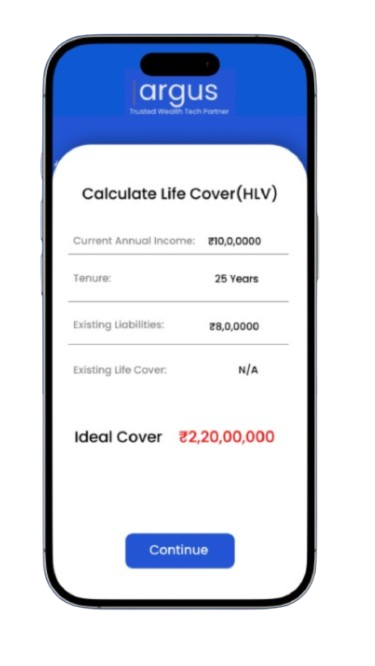

Most insurance sales today are product-first, not client-first. We’re here to change that. Argus helps turn policy data into insights, and sales into genuine advice using IRR and Human Life Value (HLV) metrics.

Why We Exist?

Clarity In Every Clause.Confidence In Every Call

Most insurance sales today are product-first, not client-first. We’re here to change that. Argus helps turn policy data into insights, and sales into genuine advice using IRR and Human Life Value (HLV) metrics.

What We Do?

Clarity in every policy. Confidence in every promise

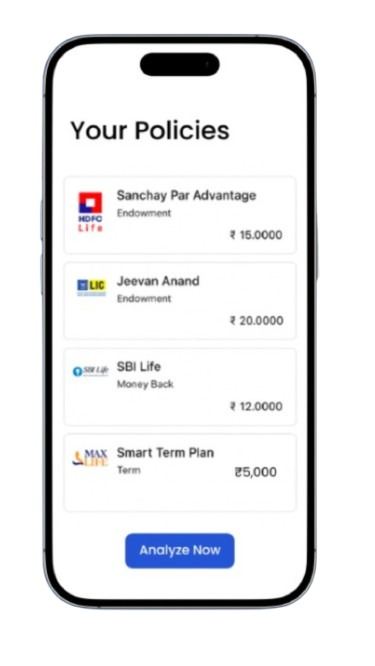

- Argus Lite: For individual advisors to analyse policies and give IRR-based advice in seconds.

- Argus Embedded: For banks and NBFCs to integrate Argus via API or plugin into their RM systems.

How We’re Building?

Data-first

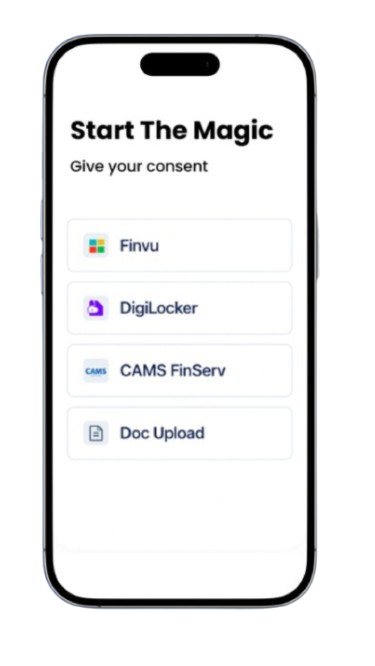

Secure integration with DigiLocker, CAMS, and Account Aggregator.

AI - Enabled

Smart scoring of policies using IRR, bonus data, and HLV.

Compliance-Ready

With consent logs, data masking, and audit support.